Probabilistic Momentum with Intraday data

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

I want to follow up the Intraday data post with testing the Probabilistic Momentum strategy on Intraday data. I will use Intraday data for SPY and GLD from the Bonnot Gang to test the strategy.

##############################################################################

# Load Systematic Investor Toolbox (SIT)

# http://systematicinvestor.wordpress.com/systematic-investor-toolbox/

###############################################################################

setInternet2(TRUE)

con = gzcon(url('http://www.systematicportfolio.com/sit.gz', 'rb'))

source(con)

close(con)

#*****************************************************************

# Load historical data

#******************************************************************

load.packages('quantmod')

# data from http://thebonnotgang.com/tbg/historical-data/

# please save SPY and GLD 1 min data at the given path

spath = 'c:/Desktop/'

data = bt.load.thebonnotgang.data('SPY,GLD', spath)

data1 <- new.env()

data1$FI = data$GLD

data1$EQ = data$SPY

data = data1

bt.prep(data, align='keep.all', fill.gaps = T)

lookback.len = 120

confidence.level = 60/100

prices = data$prices

ret = prices / mlag(prices) - 1

models = list()

#*****************************************************************

# Simple Momentum

#******************************************************************

momentum = prices / mlag(prices, lookback.len)

data$weight[] = NA

data$weight$EQ[] = momentum$EQ > momentum$FI

data$weight$FI[] = momentum$EQ <= momentum$FI

models$Simple = bt.run.share(data, clean.signal=T)

#*****************************************************************

# Probabilistic Momentum + Confidence Level

# http://cssanalytics.wordpress.com/2014/01/28/are-simple-momentum-strategies-too-dumb-introducing-probabilistic-momentum/

# http://cssanalytics.wordpress.com/2014/02/12/probabilistic-momentum-spreadsheet/

#******************************************************************

ir = sqrt(lookback.len) * runMean(ret$EQ - ret$FI, lookback.len) / runSD(ret$EQ - ret$FI, lookback.len)

momentum.p = pt(ir, lookback.len - 1)

data$weight[] = NA

data$weight$EQ[] = iif(cross.up(momentum.p, confidence.level), 1, iif(cross.dn(momentum.p, (1 - confidence.level)), 0,NA))

data$weight$FI[] = iif(cross.dn(momentum.p, (1 - confidence.level)), 1, iif(cross.up(momentum.p, confidence.level), 0,NA))

models$Probabilistic = bt.run.share(data, clean.signal=T)

data$weight[] = NA

data$weight$EQ[] = iif(cross.up(momentum.p, confidence.level), 1, iif(cross.up(momentum.p, (1 - confidence.level)), 0,NA))

data$weight$FI[] = iif(cross.dn(momentum.p, (1 - confidence.level)), 1, iif(cross.up(momentum.p, confidence.level), 0,NA))

models$Probabilistic.Leverage = bt.run.share(data, clean.signal=T)

#*****************************************************************

# Create Report

#******************************************************************

strategy.performance.snapshoot(models, T)

Next, let’s examine the hourly perfromance of the strategy.

#*****************************************************************

# Hourly Performance

#******************************************************************

strategy.name = 'Probabilistic.Leverage'

ret = models[[strategy.name]]$ret

ret.number = 100*as.double(ret)

dates = index(ret)

factor = format(dates, '%H')

layout(1:2)

par(mar=c(4,4,1,1))

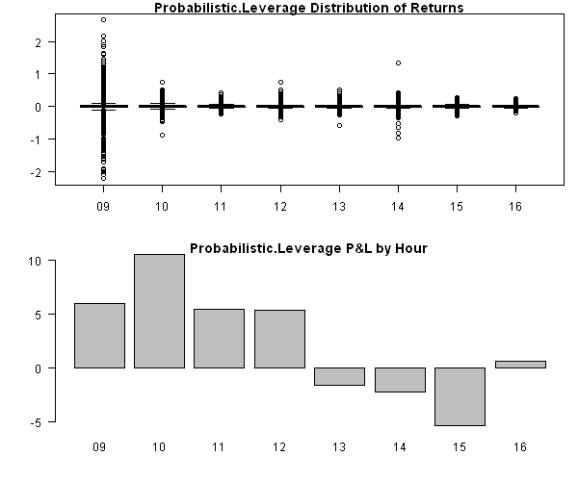

boxplot(tapply(ret.number, factor, function(x) x),outline=T, main=paste(strategy.name, 'Distribution of Returns'), las=1)

barplot(tapply(ret.number, factor, function(x) sum(x)), main=paste(strategy.name, 'P&L by Hour'), las=1)

There are lots of abnormal returns in the 9:30-10:00am box due to big overnight returns. I.e. a return from today’s open to prior’s day close. If we exclude this observation every day, the distribution each hour is more consistent.

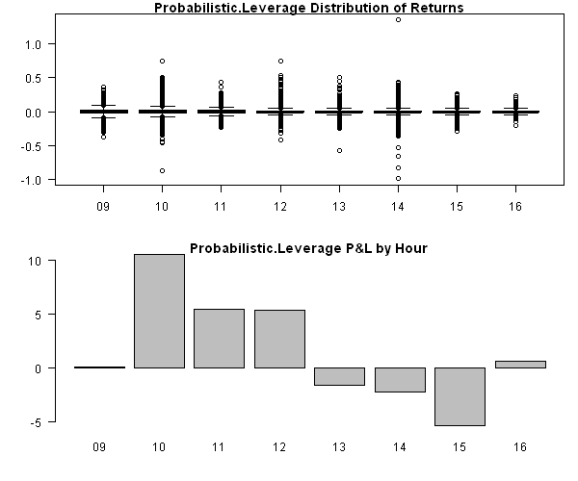

#***************************************************************** # Hourly Performance: Remove first return of the day (i.e. overnight) #****************************************************************** day.stat = bt.intraday.day(dates) ret.number[day.stat$day.start] = 0 layout(1:2) par(mar=c(4,4,1,1)) boxplot(tapply(ret.number, factor, function(x) x),outline=T, main=paste(strategy.name, 'Distribution of Returns'), las=1) barplot(tapply(ret.number, factor, function(x) sum(x)), main=paste(strategy.name, 'P&L by Hour'), las=1)

The strategy performs best in the morning and dwindles down in the afternoon and overnight.

These hourly seasonality plots are just a different way to analyze performance of the strategy based on Intraday data.

To view the complete source code for this example, please have a look at the bt.strategy.intraday.thebonnotgang.test() function in bt.test.r at github.

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you're looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.