Averaged Input Assumptions and Momentum

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

Today I want to share another interesting idea contributed by Pierre Chretien. Pierre suggested using Averaged Input Assumptions and Momentum to create reasonably quiet strategy. The averaging techniques are used to avoid over-fitting any particular frequency.

To create Averaged Input Assumptions we combine returns over different look-back periods, giving more weight to the recent returns, to form overall Input Assumptions.

create.ia.averaged <- function(lookbacks, n.lag) {

lookbacks = lookbacks

n.lag = n.lag

function(hist.returns, index=1:ncol(hist.returns), hist.all)

{

nperiods = nrow(hist.returns)

temp = c()

for (n.lookback in lookbacks)

temp = rbind(temp, hist.returns[(nperiods - n.lookback - n.lag + 1):(nperiods - n.lag), ])

create.ia(temp, index, hist.all)

}

}

To create Averaged Momentum we take a look-back weighted avaerage of momentums computed over different look-back periods.

momentum.averaged <- function(prices,

lookbacks = c(20,60,120,250) , # length of momentum look back

n.lag = 3

) {

momentum = 0 * prices

for (n.lookback in lookbacks) {

part.mom = mlag(prices, n.lag) / mlag(prices, n.lookback + n.lag) - 1

momentum = momentum + 252 / n.lookback * part.mom

}

momentum / len(lookbacks)

}

Next let’s compare using historical Input Assumptions vs Averaged Input Assumptions and Momentum vs Averaged Momentum. I will consider Absolute Momentum (not cross sectional), for more information about relative and absolute momentum, please see

Absolute Momentum: A Simple Rule-Based Strategy and Universal Trend-Following Overlay, Gary Antonacci, 2013

Generalized Momentum and Flexible Asset Allocation (FAA): An Heuristic Approach by W.J. Keller and H. S. Van Putten 2012

###############################################################################

# Load Systematic Investor Toolbox (SIT)

# http://systematicinvestor.wordpress.com/systematic-investor-toolbox/

###############################################################################

setInternet2(TRUE)

con = gzcon(url('http://www.systematicportfolio.com/sit.gz', 'rb'))

source(con)

close(con)

#*****************************************************************

# Load historical data

#******************************************************************

load.packages('quantmod')

# 10 funds

tickers = spl('Us.Eq = VTI + VTSMX,

Eurpoe.Eq = IEV + FIEUX,

Japan.Eq = EWJ + FJPNX,

Emer.Eq = EEM + VEIEX,

Re = RWX + VNQ + VGSIX,

Com = DBC + QRAAX,

Gold = GLD + SCGDX,

Long.Tr = TLT + VUSTX,

Mid.Tr = IEF + VFITX,

Short.Tr = SHY + VFISX')

start.date = 1998

dates = paste(start.date,'::',sep='')

data <- new.env()

getSymbols.extra(tickers, src = 'yahoo', from = '1980-01-01', env = data, set.symbolnames = T, auto.assign = T)

for(i in data$symbolnames) data[[i]] = adjustOHLC(data[[i]], use.Adjusted=T)

bt.prep(data, align='keep.all', dates=paste(start.date-2,':12::',sep=''), fill.gaps = T)

#*****************************************************************

# Setup

#******************************************************************

prices = data$prices

n = ncol(prices)

nperiods = nrow(prices)

periodicity = 'months'

period.ends = endpoints(prices, periodicity)

period.ends = period.ends[period.ends > 0]

max.product.exposure = 0.6

#*****************************************************************

# Input Assumptions

#******************************************************************

lookback.len = 40

create.ia.fn = create.ia

# input assumptions are averaged on 20, 40, 60 days using 1 day lag

ia.array = c(20,40,60)

avg.create.ia.fn = create.ia.averaged(ia.array, 1)

#*****************************************************************

# Momentum

#******************************************************************

universe = prices > 0

mom.lookback.len = 120

momentum = prices / mlag(prices, mom.lookback.len) - 1

mom.universe = ifna(momentum > 0, F)

# momentum is averaged on 20,60,120,250 days using 3 day lag

mom.array = c(20,60,120,250)

avg.momentum = momentum.averaged(prices, mom.array, 3)

avgmom.universe = ifna(avg.momentum > 0, F)

#*****************************************************************

# Algos

#******************************************************************

min.risk.fns = list(

EW = equal.weight.portfolio,

MV = min.var.portfolio,

MCE = min.corr.excel.portfolio,

MV.RSO = rso.portfolio(min.var.portfolio, 3, 100, const.ub = max.product.exposure),

MCE.RSO = rso.portfolio(min.corr.excel.portfolio, 3, 100, const.ub = max.product.exposure)

)

#*****************************************************************

# Code Strategies

#******************************************************************

make.strategy.custom <- function(name, create.ia.fn, lookback.len, universe, env) {

obj = portfolio.allocation.helper(data$prices,

periodicity = periodicity,

universe = universe,

lookback.len = lookback.len,

create.ia.fn = create.ia.fn,

const.ub = max.product.exposure,

min.risk.fns = min.risk.fns,

adjust2positive.definite = F

)

env[[name]] = create.strategies(obj, data, prefix=paste(name,'.',sep=''))$models

}

models <- new.env()

make.strategy.custom('ia.none' , create.ia.fn , lookback.len, universe , models)

make.strategy.custom('ia.mom' , create.ia.fn , lookback.len, mom.universe , models)

make.strategy.custom('ia.avg_mom' , create.ia.fn , lookback.len, avgmom.universe, models)

make.strategy.custom('avg_ia.none' , avg.create.ia.fn, 252 , universe , models)

make.strategy.custom('avg_ia.mom' , avg.create.ia.fn, 252 , mom.universe , models)

make.strategy.custom('avg_ia.avg_mom' , avg.create.ia.fn, 252 , avgmom.universe, models)

#*****************************************************************

# Create Report

#*****************************************************************

strategy.snapshot.custom <- function(models, n = 0, title = NULL) {

if (n > 0)

models = models[ as.vector(matrix(1:len(models),ncol=n, byrow=T)) ]

layout(1:3)

plotbt(models, plotX = T, log = 'y', LeftMargin = 3, main = title)

mtext('Cumulative Performance', side = 2, line = 1)

plotbt.strategy.sidebyside(models)

barplot.with.labels(sapply(models, compute.turnover, data), 'Average Annual Portfolio Turnover', T)

}

# basic vs basic + momentum => momentum filter has better results

models.final = c(models$ia.none, models$ia.mom)

strategy.snapshot.custom(models.final, len(min.risk.fns), 'Momentum Filter')

# basic vs basic + avg ia => averaged ia reduce turnover

models.final = c(models$ia.none, models$avg_ia.none)

strategy.snapshot.custom(models.final, len(min.risk.fns), 'Averaged Input Assumptions')

# basic + momentum vs basic + avg.momentum => mixed results for averaged momentum

models.final = c(models$ia.mom, models$ia.avg_mom)

strategy.snapshot.custom(models.final, len(min.risk.fns), 'Averaged Momentum')

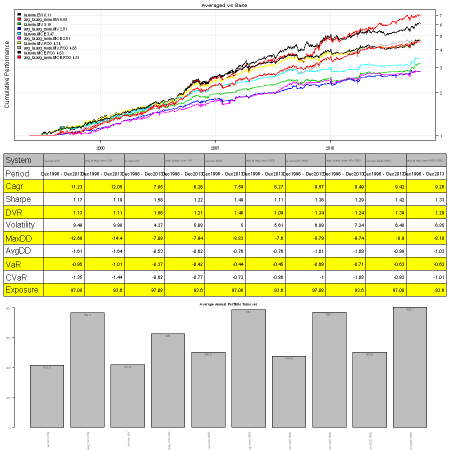

# basic + momentum vs avg ia + avg.momentum

models.final = c(models$ia.mom, models$avg_ia.avg_mom)

strategy.snapshot.custom(models.final, len(min.risk.fns), 'Averaged vs Base')

Above, I compared results for the following 4 cases:

1. Adding Momentum filter: all algos perfrom better

2. Input Assumptions vs Averaged Input Assumptions: returns are very similar, but using Averaged Input Assumptions helps reduce portfolio turnover.

3. Momentum vs Averaged Momentum: returns are very similar, but using Averaged Momentum increases portfolio turnover.

4. historical Input Assumptions + Momentum vs Averaged Input Assumptions + Averaged Momentum: results are mixed, no consistent advantage of using Averaged methods

Overall, the Averaged methods is a very interesting idea and I hope you will experiemtn with it and share your findings, like Pierre. Pierre, again thank you very much for sharing.

The full source code and example for the bt.averaged.test() function is available in bt.test.r at github.

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you're looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.