Do Torontonians Want a New Casino? Survey Analysis Part 1

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

Toronto City Council is in the midst of a very lengthy process of considering whether or not to allow the OLG to build of a new casino in Toronto, and where. The process started in November of 2012, and set out to answer this question through many and varied consultations with the public, and key stakeholders in the city.

One of the methods of public consultation that they used was a “Casino Feedback Form“, or survey that was distributed online and in person. By the time the deadline had passed to collect responses on this survey (January 25, 11:59pm), they had collected a whopping 17,780 responses. The agency seemingly responsible for the survey is called DPRA, and from what I can tell they seemed to do a pretty decent job of creating and distributing the survey.

In a very surprisingly modern and democratic form, Toronto City Council made the response data for the survey available on the Toronto Open Data website, which I couldn’t help but download and analyze for myself (with R of course!).

For a relatively small survey, it’s very rich in information. I love having hobby data sets to work with from time to time, and so I’m going to dedicate a few posts to the analysis of this response data file. This post will not show too much that’s different from the report that DPRA has already released, as it contains largely univariate analyses. In later posts however, I will get around to asking and answering those questions that are of a more multivariate nature! To preserve flow of the post, I will post the R code at the end, instead of interspersing it throughout like I normally do. Unless otherwise specified, all numerical axes represent the % of people who selected a particular response on the survey.

Without further ado, I will start with some key findings:

Key Findings

- With 17,780 responses, Toronto City Council obtained for themselves a hefty data set with pretty decent geographical coverage of the core areas of Toronto (Toronto, North York, Scarborough, Etobicoke, East York, Mississauga). This is much better than Ipsos Reid’s Casino Survey response data set of 906 respondents.

- Only 25.7% of respondents were somewhat or strongly in favour of having a new casino in Toronto. I’d say that’s overwhelmingly negative!

- Ratings of the suitability of a casino in three different locations by type of casino indicate that people are more favourable towards an Integrated Entertainment Complex (basically a casino with extra amenities) vs. a standalone casino.

- Of the three different locations, people were most favourable towards an Integrated Entertainment Complex at the Exhibition Place. However, bear in mind that only 27.4% of respondents thought it was suitable at all. This is a ‘best of the worst’ result!

- When asked to rate the importance of a list of issues surrounding the building of a new casino in Toronto, respondents rated as most important the following issues: safety, health, addiction, public space, traffic, and integration with surrounding areas.

Geographic Distribution of Responses

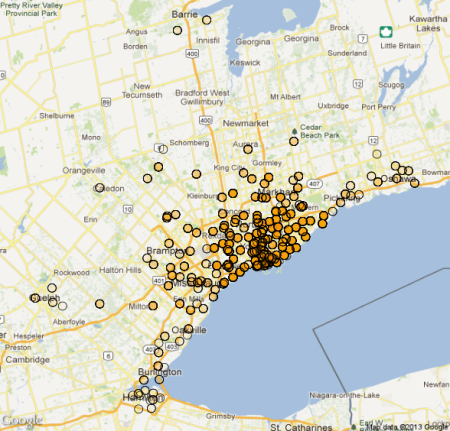

In a relatively short time, City Council managed to collect many responses to their survey. I wanted to look at the geographic distribution of all of these responses. Luckily, the survey included a question that asked for the first 3 characters of the respondents’ postal code (or FSA). If you have a file containing geocoded postal codes, you then can plot the respondents on a map. I managed to find such a file on a website called geocoder.ca, with latitude and longitude coordinates for over 90,000 postal codes). Once I got the file into R, I made sure that all FSA codes in the survey data were capitalized, created an FSA column in the geocoded file, and then merged the geocoded dataset into the survey dataset. This isn’t a completely valid approach, but when looking at a broad area, I don’t think the errors in plotting points on a map aren’t going to look that serious.

For a survey about Toronto, the geographic distribution was actually pretty wide. Have a look at the complete distribution:

Obviously there seem to be a whole lot of responses in Southern Ontario, but we even see a smattering of responses in neighbouring provinces as well. However, let’s look at a way of zooming in on the large cluster of Southern Ontario cities. From the postal codes, I was able to get the city in which each response was made. From that I pulled out what looked like a good cluster of top southern ontario cities:

City # Responses

Toronto 8389

North York 1553

Scarborough 1145

Etobicoke 936

East York 462

Mississauga 201

Markham 149

Brampton 111

Richmond Hill 79

Thornhill 62

York 59

Maple 58

Milton 30

Oakville 30

Woodbridge 30

Burlington 28

Oshawa 25

Pickering 22

Whitby 19

Hamilton 17

Bolton 14

Guelph 13

Nobleton 12

Aurora 11

Ajax 10

Caledon 10

Stouffville 10

Barrie 9

Lots of people in Toronto, obviously, a fair amount in North York, Scarborough, and Etobicoke, and then it leaps downwards in frequency from there. However, these city labels are from the geocoding, and who knows if some people it places in Toronto are actually from North York (the tree, then one of its apples). So, I filtered the latitude and longitude coordinates based on this top list to get the following zoomed-in map:

Much better than a table! I used transparency on the colours of the circles to help better distinguish dense clusters of responses from sparse ones. Based on the map, I can see 3 patterns:

Much better than a table! I used transparency on the colours of the circles to help better distinguish dense clusters of responses from sparse ones. Based on the map, I can see 3 patterns:

1) It looks like there is a huge cluster of responses came from an area of Toronto approximately bounded by Dufferin on the West, highway 404 on the east, the Gardiner on the south, and the 401 on the north.

2) There’s also an interesting vertical cluster that seems to go from well south of highway 400 and the 401, and travels north to the 407.

3) I’m not sure I would call this a cluster per se, but there definitely seems to be a pattern where you find responses all the way along the Gardiner Expressway/Queen Elizabeth Way/Kingston Road/401 from Burlington to Oshawa.

Now for the survey results!

Demographics of Respondents

Click to view slideshow.As you can see, about 80% of the respondents disclosed their gender, with a noticeable bias towards men. Also, most of the respondents who disclosed their age were between 25 and 64 years of age. This might be a disadvantage, according to a recent report by Statistics Canada on gambling. If you look at page 6 on the report, you will see that of all age groups of female gamblers, those 65 and older are spending the most amount of money on Casinos, Slot Machines, and VLTs per 1 person spending household. However, I guess it’s better having some information than no information.

Feelings about the new casino

Well, isn’t that something? Only about a quarter of all people surveyed actually have positive feelings about a new casino! I have to say this is pretty telling. You would think this would be damning information, but here’s where we fall into the trap of whether or not to trust a survey result.

Here we have this telling response, but then again, Ipsos Reid conducted a poll that gathered 906 responses that concluded that 52% of Torontonians “either strongly or somewhat support a new gambling venue within its borders”. People were asked about their support of a new casino at the beginning and ending. At the end, after they supplied people with all the various arguments supplied by both sides of the debate, they asked the question again. Apparently the proportion supporting the casino was 54% when analyzing the second instance of the question. They don’t even link to the original question form, so I’m left to wonder exactly how it was phrased, and what preceded it. The only hint is in this phrase: “ if a vote were held tomorrow on the idea of building a casino in the city of Toronto…”. Does that seem comparable to you?

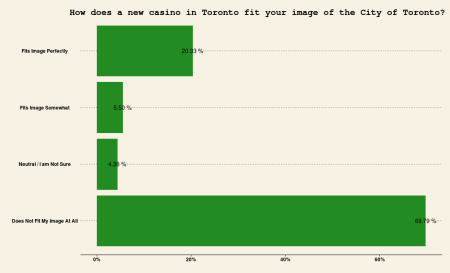

A Casino for “Toronto The Good”?

This question seems to be pretty similar to the first question. If a new casino fits your image of Toronto perfectly, then you’re probably going to be strongly in favour of one! Obviously, most people seem pretty sure that a new casino just isn’t the kind of thing that would fit in with their image of “Toronto the Good”.

Where to build a new casino

In the response pattern here, we seem to see a kind of ‘not in/near my backyard’ mentality going on. A slight majority of respondents seem to be saying that if a new casino is to be built, it should be somewhere decently far away from Toronto, perhaps so that they don’t have to deal with the consequences. I’ll eat my sock if the “Neither” folks aren’t those who also were strongly opposed to the casino.

In the response pattern here, we seem to see a kind of ‘not in/near my backyard’ mentality going on. A slight majority of respondents seem to be saying that if a new casino is to be built, it should be somewhere decently far away from Toronto, perhaps so that they don’t have to deal with the consequences. I’ll eat my sock if the “Neither” folks aren’t those who also were strongly opposed to the casino.

They also asked respondents to rate the suitability of a new casino in three different locations:

- A downtown area (bounded by Spadina Avenue, King Street, Jarvis Street and Queens Quay)

- Exhibition Place (bounded by Gardiner Expressway, Lake Shore Boulevard, Dufferin Street and Strachan Avenue)

- Port Lands (located south of the Don Valley and Gardiner/Lake Shore, east of the downtown core)

Looking at the above 3 graphs, you see right away that a kind of casino called an Integrated Entertainment Complex (kind of a smorgasboard of casino, restaurant, theatre, hotel, etc.) is more favourable than a standalone casino at any location. That being said, the responses are still largely negative! Out of the 3 options for location of an Integrated Entertainment Complex (IEC), it was Exhibition Place that rated the most positive by a small margin (18.1% said highly suitable, vs. 16.2% for downtown Toronto). There are definitely those at the Exhibition Place who want the Toronto landmark to be chosen!

Desired Features of IEC by Location

Click to view slideshow.These charts indicate that, for those who can imagine an Integrated Entertainment Complex in either of the 3 locations, they would like features at that locations that allow them to sit/stand and enjoy themselves. Restaurants, Cultural and Arts Facilities, and Theatre are tops in all 3 locations (but still bear in mind that less than half opted for those choices). A quick google search reveals that restaurants and theatres are mentioned in a large number of search results. An article in the Toronto Sun boasts that an Integrated Entertainment Complex would catapult Toronto into the stars as even more of a tourist destination. Interestingly, the article also mentions the high monetary value of convention visitors and how much that would add to the revenues generated for the city. I find it funny that the popularity of having convention centre space in this survey is at its highest when people are asked about the Exhibition Place. The Exhibition Place already has convention centre space!! I don’t understand the logic, but maybe someone will explain it to me.

Issues of Importance Surrounding a New Casino

Unlike the previous graphs, this one charts the % who gave a particular response on each item. In this case, the graph shows the % of respondents who gave gave the answer “Very Important” when asked to rate each issue surrounding the new casino. Unlike some of the previous questions, this one did not include a “No Casino” option, so already more people can contribute positively to the response distribution. You can already see that people are pretty riled up about some serious social and environmental issues. They’re worried about safety, health, addiction, public space (sounds like a worry about clutter to me), traffic, and integration with surrounding areas. I’ll bet that the people worried about these top 5 issues are the people most likely to say that they don’t want a casino anywhere. It will be interesting to uncover some factor structure here and then find out what the pro and anti casino folks are concerned with.

Unlike the previous graphs, this one charts the % who gave a particular response on each item. In this case, the graph shows the % of respondents who gave gave the answer “Very Important” when asked to rate each issue surrounding the new casino. Unlike some of the previous questions, this one did not include a “No Casino” option, so already more people can contribute positively to the response distribution. You can already see that people are pretty riled up about some serious social and environmental issues. They’re worried about safety, health, addiction, public space (sounds like a worry about clutter to me), traffic, and integration with surrounding areas. I’ll bet that the people worried about these top 5 issues are the people most likely to say that they don’t want a casino anywhere. It will be interesting to uncover some factor structure here and then find out what the pro and anti casino folks are concerned with.

For my next post, I have in mind to investigate a few simple questions so far:

- Who exactly wants or doesn’t want a new casino, and where? What are they most concerned with (those who do and don’t want a casino)

- Is there a “not in my backyard” effect going on, where those who are closest to the proposed casino spots are the least likely to want it there, but more likely to want a casino elsewhere? I have latitude/longitude coordinates, and can convert them into distances from the proposed casino spots. I think that will be interesting to look at!

| library(ff) | |

| library(ffbase) | |

| library(stringr) | |

| library(ggplot2) | |

| library(ggthemes) | |

| library(reshape2) | |

| library(RgoogleMaps) | |

| # Loading 2 copies of the same data set so that I can convert one and have the original for its text values | |

| casino = read.csv("/home/inkhorn/Downloads/casino_survey_results20130325.csv") | |

| casino.orig = read.csv("/home/inkhorn/Downloads/casino_survey_results20130325.csv") | |

| # Here's the dataset of canadian postal codes and latitude/longitude coordinates | |

| pcodes = read.csv.ffdf(file="/home/inkhorn/Downloads/zipcodeset.txt", first.rows=50000, next.rows=50000, colClasses=NA, header=FALSE) | |

| # I'm doing some numerical recoding here. If you can tell me a cleaner way of doing this | |

| # then by all means please do. I found this process really annoyingly tedious. | |

| casino$Q1_A = ifelse(casino.orig$Q1_A == "Neutral or Mixed Feelings", 3, | |

| ifelse(casino.orig$Q1_A == "Somewhat in Favour", 4, | |

| ifelse(casino.orig$Q1_A == "Somewhat Opposed", 2, | |

| ifelse(casino.orig$Q1_A == "Strongly in Favour", 5, | |

| ifelse(casino.orig$Q1_A == "Strongly Opposed", 1,NA))))) | |

| casino$Q2_A = ifelse(casino.orig$Q2_A == "Does Not Fit My Image At All", 1, | |

| ifelse(casino.orig$Q2_A == "Neutral / I am Not Sure",2, | |

| ifelse(casino.orig$Q2_A == "Fits Image Somewhat", 3, | |

| ifelse(casino.orig$Q2_A == "Fits Image Perfectly", 4, NA)))) | |

| for (i in 8:24) { | |

| casino[,i] = ifelse(casino.orig[,i] == "Not Important At All", 1, | |

| ifelse(casino.orig[,i] == "Somewhat Important", 2, | |

| ifelse(casino.orig[,i] == "Very Important", 3,NA)))} | |

| for (i in c(31:32,47,48,63,64)) { | |

| casino[,i] = ifelse(casino.orig[,i] == "Highly Suitable",5, | |

| ifelse(casino.orig[,i] == "Neutral or Mixed Feelings",3, | |

| ifelse(casino.orig[,i] == "Somewhat Suitable",4, | |

| ifelse(casino.orig[,i] == "Somewhat Unsuitable",2, | |

| ifelse(casino.orig[,i] == "Strongly Unsuitable",1,NA)))))} | |

| # There tended to be blank responses in the original dataset. When seeking to | |

| # plot the responses in their original text option format, I got rid of them in some cases, | |

| # or coded them in "Did not disclose" in others. | |

| casino.orig$Q1_A[casino.orig$Q1_A == ""] = NA | |

| casino.orig$Q1_A = factor(casino.orig$Q1_A, levels=c("Strongly Opposed","Somewhat Opposed","Neutral or Mixed Feelings","Somewhat in Favour","Strongly in Favour")) | |

| # Here's the graph showing how people feel about a new casino | |

| ggplot(subset(casino.orig, !is.na(Q1_A)), aes(x=Q1_A,y=..count../sum(..count..))) + geom_bar(fill="forest green") + coord_flip() + ggtitle("How do you feel about having a new casino in Toronto?") + scale_x_discrete(name="") + theme_wsj() + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + stat_bin(aes(label = sprintf("%.02f %%", ..count../sum(..count..)*100)), geom="text") + scale_y_continuous(labels=percent) | |

| # How does the casino fit into your image of toronto... | |

| ggplot(subset(casino.orig, Q2_A!= ''), aes(x=Q2_A,y=..count../sum(..count..))) + geom_bar(fill="forest green") + coord_flip() + ggtitle("How does a new casino in Toronto fit your image of the City of Toronto?") + scale_x_discrete(name="") + theme_wsj() + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + stat_bin(aes(label = sprintf("%.02f %%", ..count../sum(..count..)*100)),geom="text") + scale_y_continuous(labels=percent) | |

| # Where you'd prefer to see it located | |

| ggplot(subset(casino.orig, Q6!= ''), aes(x=Q6,y=..count../sum(..count..))) + geom_bar(fill="forest green") + coord_flip() + ggtitle("If a casino is built, where would you prefer to see it located?") + scale_x_discrete(name="") + theme_wsj() + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + stat_bin(aes(label = sprintf("%.02f %%", ..count../sum(..count..)*100)), geom="text") + scale_y_continuous(labels=percent) | |

| # Here I reorder the text labels from the questions asking about suitability of the downtown location | |

| casino.orig$Q7_A_StandAlone = reorder(casino.orig$Q7_A_StandAlone, casino$Q7_A_StandAlone) | |

| casino.orig$Q7_A_Integrated = reorder(casino.orig$Q7_A_Integrated, casino$Q7_A_Integrated) | |

| # Reshaping the downtown ratings data for graphing.. | |

| stand.and.integrated.ratings.downtown = cbind(prop.table(as.matrix(table(casino.orig$Q7_A_StandAlone)[1:5])), | |

| prop.table(as.matrix(table(casino.orig$Q7_A_Integrated)[1:5]))) | |

| colnames(stand.and.integrated.ratings.downtown) = c("Standalone Casino","Integrated Entertainment Complex") | |

| stand.and.integrated.ratings.downtown.long = melt(stand.and.integrated.ratings.downtown, varnames=c("Rating","Casino Type"), value.name="Percentage") | |

| # Graphing ratings of casino suitability for the downtown location | |

| ggplot(stand.and.integrated.ratings.downtown.long, aes(x=stand.and.integrated.ratings.downtown.long$"Casino Type", fill=Rating, y=Percentage,label=sprintf("%.02f %%", Percentage*100))) + geom_bar(position="dodge") + coord_flip() + ggtitle("Ratings of Casino Suitability \nin Downtown Toronto by Casino Type") + scale_x_discrete(name="") + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + scale_y_continuous(labels=percent) + geom_text(aes(x=stand.and.integrated.ratings.downtown.long$"Casino Type", y=Percentage, ymax=Percentage, label=sprintf("%.01f%%",Percentage*100), hjust=.75),position = position_dodge(width=1),size=4) + scale_fill_few(palette="light") + theme_wsj() | |

| # Reshaping the exhibition place ratings for graphing | |

| stand.and.integrated.ratings.exhibition = cbind(prop.table(as.matrix(table(casino.orig$Q7_B_StandAlone)[2:6])), | |

| prop.table(as.matrix(table(casino.orig$Q7_B_Integrated)[2:6]))) | |

| colnames(stand.and.integrated.ratings.exhibition) = c("Standalone Casino","Integrated Entertainment Complex") | |

| stand.and.integrated.ratings.exhibition.long = melt(stand.and.integrated.ratings.exhibition, varnames=c("Rating","Casino Type"), value.name="Percentage") | |

| # Reordering the rating text labels for the graphing. | |

| stand.and.integrated.ratings.exhibition.long$Rating = factor(stand.and.integrated.ratings.exhibition.long$Rating, levels=levels(casino.orig$Q7_A_StandAlone)[1:5]) | |

| # Graphing ratings of casino suitability for the exhibition place location | |

| ggplot(stand.and.integrated.ratings.exhibition.long, aes(x=stand.and.integrated.ratings.exhibition.long$"Casino Type", fill=Rating, y=Percentage,label=sprintf("%.02f %%", Percentage*100))) + geom_bar(position="dodge") + coord_flip() + ggtitle("Ratings of Casino Suitability \nat Exhibition Place by Casino Type") + scale_x_discrete(name="") + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + scale_y_continuous(labels=percent) + geom_text(aes(x=stand.and.integrated.ratings.exhibition.long$"Casino Type", y=Percentage, ymax=Percentage, label=sprintf("%.01f%%",Percentage*100), hjust=.75), position = position_dodge(width=1),size=4) + scale_fill_few(palette="light") + theme_wsj() | |

| # Reshaping the Port Lands ratings for graphing | |

| stand.and.integrated.ratings.portlands = cbind(prop.table(as.matrix(table(casino.orig$Q7_C_StandAlone)[2:6])), | |

| prop.table(as.matrix(table(casino.orig$Q7_C_Integrated)[2:6]))) | |

| colnames(stand.and.integrated.ratings.portlands) = c("Standalone Casino", "Integrated Entertainment Complex") | |

| stand.and.integrated.ratings.portlands.long = melt(stand.and.integrated.ratings.portlands, varnames=c("Rating","Casino Type"), value.name="Percentage") | |

| # Reording the rating text labels for the graping. | |

| stand.and.integrated.ratings.portlands.long$Rating = factor(stand.and.integrated.ratings.portlands.long$Rating, levels=levels(casino.orig$Q7_A_StandAlone)[1:5]) | |

| # Graphing ratings of casino suitability for the port lands location | |

| ggplot(stand.and.integrated.ratings.portlands.long, aes(x=stand.and.integrated.ratings.portlands.long$"Casino Type", fill=Rating, y=Percentage,label=sprintf("%.02f %%", Percentage*100))) + geom_bar(position="dodge") + coord_flip() + ggtitle("Ratings of Casino Suitability \nat Port Lands by Casino Type") + scale_x_discrete(name="") + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + scale_y_continuous(labels=percent) + geom_text(aes(x=stand.and.integrated.ratings.portlands.long$"Casino Type", y=Percentage, ymax=Percentage, label=sprintf("%.01f%%",Percentage*100), hjust=.75), position = position_dodge(width=1),size=4) + scale_fill_few(palette="light") + theme_wsj() | |

| # This was the part in my analysis where I looked at postal codes (FSAs really) and their coordinates | |

| # Sorry I'm not more linear in how I do my analysis vs. write about it :) | |

| # You'll notice that I've imported the geocode file as ffdf. This led to faster merging with the | |

| # original casino data set. This meant that I had to coerce the casino.orig data frame into ffdf format | |

| # But I work with it every day at work, so I'm used to it by now, despite its idiosynchracies. | |

| casino.orig$PostalCode = toupper(casino.orig$PostalCode) | |

| pcodes = read.csv.ffdf(file="/home/inkhorn/Downloads/zipcodeset.txt", first.rows=50000, next.rows=50000, colClasses=NA, header=FALSE) | |

| names(pcodes) = c("Postal","Lat","Long","City","Prov") | |

| pcodes$FSA = as.ff(as.factor(toupper(substr(pcodes[,"Postal"], 1,3)))) | |

| casino.orig = as.ffdf(casino.orig) | |

| casino.orig$PostalCode = as.ff(as.factor(toupper(casino.orig[,"PostalCode"]))) | |

| casino.orig = merge(casino.orig, pcodes, by.x="PostalCode", by.y="FSA", all.x=TRUE) | |

| # This is the code for the full map I generated | |

| casino.gc = casino.orig[which(!is.na(casino.orig[,"Lat"])),] # making sure only records with coordinates are included... | |

| mymap = MapBackground(lat=casino.gc$Lat, lon=casino.gc$Long) | |

| PlotOnStaticMap(mymap, casino.gc$Lat, casino.gc$Long, cex=1.5, pch=21, bg="orange") | |

| # Here I'm getting a list of cities, winnowing it down, and using it to filter the | |

| # geocode coordinates to zoom in on the map I generated. | |

| cities = data.frame(table(casino.orig[,"City"])) | |

| cities = cities[cities$Freq > 0,] | |

| cities = cities[order(cities$Freq, decreasing=TRUE),] | |

| cities = cities[cities$Var1 != '',] | |

| cities.filter = cities[1:28,] # Here's my top cities variable (i set an arbitrary dividing line...) | |

| names(cities.filter) = c("City","# Responses") | |

| # Here's where I filtered the original casino ffdf so that it only contained the cities | |

| # that I wanted to see in Southern Ontario | |

| casino.top.so = casino.orig[which(casino.orig[,"City"] %in% cities.filter$Var1),] | |

| # here's a transparency function that I used for the southern ontario map | |

| addTrans <- function(color,trans) | |

| { | |

| # This function adds transparancy to a color. | |

| # Define transparancy with an integer between 0 and 255 | |

| # 0 being fully transparant and 255 being fully visable | |

| # Works with either color and trans a vector of equal length, | |

| # or one of the two of length 1. | |

| if (length(color)!=length(trans)&!any(c(length(color),length(trans))==1)) stop("Vector lengths not correct") | |

| if (length(color)==1 & length(trans)>1) color <- rep(color,length(trans)) | |

| if (length(trans)==1 & length(color)>1) trans <- rep(trans,length(color)) | |

| num2hex <- function(x) | |

| { | |

| hex <- unlist(strsplit("0123456789ABCDEF",split="")) | |

| return(paste(hex[(x-x%%16)/16+1],hex[x%%16+1],sep="")) | |

| } | |

| rgb <- rbind(col2rgb(color),trans) | |

| res <- paste("#",apply(apply(rgb,2,num2hex),2,paste,collapse=""),sep="") | |

| return(res) | |

| } | |

| # Finally here's the southern ontario map code | |

| mymap = MapBackground(lat=casino.top.so$Lat, lon=casino.top.so$Long) | |

| PlotOnStaticMap(mymap, casino.top.so$Lat, casino.top.so$Long, cex=1.5, pch=21, bg=addTrans("orange",10)) | |

| # Here's some code for summarizing and plotting the response data to the question | |

| # around issues of importance regarding the new casino (question 3) | |

| q3.summary = matrix(NA, 16,1,dimnames=list(c("Design of the facility", | |

| "Employment opportunities","Entertainment and cultural activities", | |

| "Expanded convention facilities", "Integration with surrounding areas", | |

| "New hotel accommodations","Problem gambling & health concerns", | |

| "Public safety and social concerns","Public space", | |

| "Restaurants","Retail","Revenue for the City","Support for local businesses", | |

| "Tourist attraction","Traffic concerns","Training and career development"),c("% Very Important"))) | |

| for (i in 8:23) { | |

| q3.summary[i-7] = mean(casino[,i] == 3, na.rm=TRUE)} | |

| q3.summary = as.data.frame(q3.summary[order(q3.summary[,1], decreasing = FALSE),]) | |

| names(q3.summary)[1] = "% Very Important" | |

| q3.summary$Concern = rownames(q3.summary) | |

| q3.summary = q3.summary[order(q3.summary$"% Very Important", decreasing=FALSE),] | |

| q3.summary$Concern = factor(q3.summary$Concern, levels=q3.summary$Concern) | |

| ggplot(q3.summary, aes(x=Concern, y=q3.summary$"% Very Important")) + geom_point(size=5, colour="forest green") + coord_flip() + ggtitle("Issues of Importance Surrounding\nthe New Casino") + scale_x_discrete(name="Issues of Importance") + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + scale_y_continuous(labels=percent) + theme_wsj() | |

| # This chunk of code deals with summarizing and plotting the questions surrounding | |

| # what features people might want if a new Integrated Entertainment Complex is built | |

| q7a.summary = matrix(NA, 9,1, dimnames=list(c("No Casino","Casino Only", "Convention Centre Space", "Cultural and Arts Facilities", | |

| "Hotel","Nightclubs","Restaurants","Retail","Theatre"),c("% Include"))) | |

| for (i in 36:44) { | |

| q7a.summary[i-35] = mean(casino[,i], na.rm=TRUE)} | |

| q7a.summary = as.data.frame(q7a.summary[order(q7a.summary[,1], decreasing = FALSE),]) | |

| names(q7a.summary)[1] = "% Include" | |

| q7a.summary$feature = rownames(q7a.summary) | |

| q7a.summary$feature = factor(q7a.summary$feature, levels=q7a.summary$feature) | |

| ggplot(q7a.summary, aes(x=feature, y=q7a.summary$"% Include")) + geom_point(size=5, colour="forest green") + coord_flip() + ggtitle("What People Would Want in an Integrated\nEntertainment Complex in Downtown Toronto") + scale_x_discrete(name="Features") + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + scale_y_continuous(labels=percent,name="% Wanting the Feature") + theme_wsj() | |

| q7b.summary = matrix(NA, 9,1, dimnames=list(c("No Casino","Casino Only", "Convention Centre Space", "Cultural and Arts Facilities", | |

| "Hotel","Nightclubs","Restaurants","Retail","Theatre"),c("% Include"))) | |

| for (i in 52:60) { | |

| q7b.summary[i-51] = mean(casino[,i], na.rm=TRUE)} | |

| q7b.summary = as.data.frame(q7b.summary[order(q7b.summary[,1], decreasing = FALSE),]) | |

| names(q7b.summary)[1] = "% Include" | |

| q7b.summary$feature = rownames(q7b.summary) | |

| q7b.summary$feature = factor(q7b.summary$feature, levels=q7b.summary$feature) | |

| ggplot(q7b.summary, aes(x=feature, y=q7b.summary$"% Include")) + geom_point(size=5, colour="forest green") + coord_flip() + ggtitle("What People Would Want in an Integrated\nEntertainment Complex at the Exhbition Place") + scale_x_discrete(name="Features") + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + scale_y_continuous(labels=percent,name="% Wanting the Feature") + theme_wsj() | |

| q7c.summary = matrix(NA, 9,1, dimnames=list(c("No Casino","Casino Only", "Convention Centre Space", "Cultural and Arts Facilities", | |

| "Hotel","Nightclubs","Restaurants","Retail","Theatre"),c("% Include"))) | |

| for (i in 68:76) { | |

| q7c.summary[i-67] = mean(casino[,i], na.rm=TRUE)} | |

| q7c.summary = as.data.frame(q7c.summary[order(q7c.summary[,1], decreasing = FALSE),]) | |

| names(q7c.summary)[1] = "% Include" | |

| q7c.summary$feature = rownames(q7c.summary) | |

| q7c.summary$feature = factor(q7c.summary$feature, levels=q7c.summary$feature) | |

| ggplot(q7c.summary, aes(x=feature, y=q7b.summary$"% Include")) + geom_point(size=5, colour="forest green") + coord_flip() + ggtitle("What People Would Want in an Integrated\nEntertainment Complex in Port Lands") + scale_x_discrete(name="Features") + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + scale_y_continuous(labels=percent,name="% Wanting the Feature") + theme_wsj() | |

| # It sucks, but I imported yet another version of the casino dataset so that I wouldn't have to use | |

| # the annoying ffdf indexing notation (e.g. df[,"variable1"]) | |

| casino.orig2 = read.csv("/home/inkhorn/Downloads/casino_survey_results20130325.csv") | |

| # Finally, here's some code where I processed and plotted the Gender and Age demographic variables | |

| casino$Gender = casino.orig$Gender | |

| casino$Gender = ifelse(!(casino.orig2$Gender %in% c("Female","Male","Transgendered")), "Did not disclose", | |

| ifelse(casino.orig2$Gender == "Female","Female", | |

| ifelse(casino.orig2$Gender == "Male","Male","Transgendered"))) | |

| casino$Gender = factor(casino$Gender, levels=c("Transgendered","Did not disclose","Female","Male")) | |

| ggplot(casino, aes(x=Gender,y=..count../sum(..count..))) + geom_bar(fill="forest green") + coord_flip() + ggtitle("Gender Distribution of Respondents") + scale_x_discrete(name="") + theme_wsj() + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + stat_bin(aes(label = sprintf("%.02f %%", ..count../sum(..count..)*100)), | |

| geom="text") + scale_y_continuous(labels=percent) | |

| casino$Age = ifelse(casino.orig2$Age == "", "Did not disclose", | |

| ifelse(casino.orig2$Age == "Under 15", "Under 15", | |

| ifelse(casino.orig2$Age == "15-24", "15-24", | |

| ifelse(casino.orig2$Age == "25-34", "25-34", | |

| ifelse(casino.orig2$Age == "35-44", "35-44", | |

| ifelse(casino.orig2$Age == "45-54","45-54", | |

| ifelse(casino.orig2$Age == "55-64","55-64", | |

| ifelse(casino.orig2$Age == "65 or older", "65 or older","Did not disclose")))))))) | |

| casino$Age = factor(casino$Age, levels=c("Did not disclose","Under 15","15-24","25-34","35-44","45-54","55-64","65 or older")) | |

| ggplot(casino, aes(x=Age,y=..count../sum(..count..))) + geom_bar(fill="forest green") + coord_flip() + ggtitle("Age Distribution of Respondents") + scale_x_discrete(name="") + theme_wsj() + theme(title=element_text(size=22),plot.title=element_text(hjust=.8)) + stat_bin(aes(label = sprintf("%.02f %%", ..count../sum(..count..)*100)), geom="text") + scale_y_continuous(labels=percent) | |

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you're looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.