Retirement : simulating wealth with random returns, inflation and withdrawals – Shiny web application

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.

Today, I want to share the Retirement : simulating wealth with random returns, inflation and withdrawals – Shiny web application (code at GitHub).

This application was developed and contributed by Pierre Chretien, I only made minor updates. This is application is a great example of how easy it is to convert your R script into interactive Shiny web application.

Please see below the sample script to simulate wealth random returns, inflation and withdrawals:

#-------------------------------------

# Inputs

#-------------------------------------

# Initial capital

start.capital = 2000000

# Investment

annual.mean.return = 5 / 100

annual.ret.std.dev = 7 / 100

# Inflation

annual.inflation = 2.5 / 100

annual.inf.std.dev = 1.5 / 100

# Withdrawals

monthly.withdrawals = 10000

# Number of observations (in Years)

n.obs = 20

# Number of simulations

n.sim = 200

#-------------------------------------

# Simulation

#-------------------------------------

# number of months to simulate

n.obs = 12 * n.obs

# monthly Investment and Inflation assumptions

monthly.mean.return = annual.mean.return / 12

monthly.ret.std.dev = annual.ret.std.dev / sqrt(12)

monthly.inflation = annual.inflation / 12

monthly.inf.std.dev = annual.inf.std.dev / sqrt(12)

# simulate Returns

monthly.invest.returns = matrix(0, n.obs, n.sim)

monthly.inflation.returns = matrix(0, n.obs, n.sim)

monthly.invest.returns[] = rnorm(n.obs * n.sim, mean = monthly.mean.return, sd = monthly.ret.std.dev)

monthly.inflation.returns[] = rnorm(n.obs * n.sim, mean = monthly.inflation, sd = monthly.inf.std.dev)

# simulate Withdrawals

nav = matrix(start.capital, n.obs + 1, n.sim)

for (j in 1:n.obs) {

nav[j + 1, ] = nav[j, ] * (1 + monthly.invest.returns[j, ] - monthly.inflation.returns[j, ]) - monthly.withdrawals

}

# once nav is below 0 => run out of money

nav[ nav < 0 ] = NA

# convert to millions

nav = nav / 1000000

#-------------------------------------

# Plots

#-------------------------------------

layout(matrix(c(1,2,1,3),2,2))

# plot all scenarios

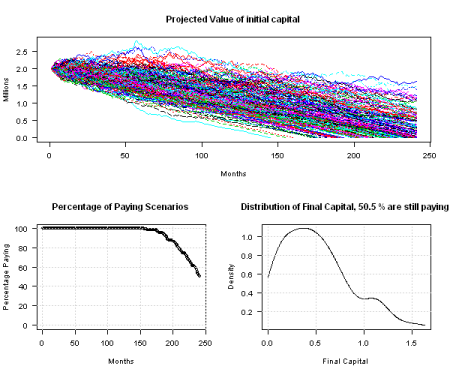

matplot(nav, type = 'l', las = 1, xlab = 'Months', ylab = 'Millions',

main = 'Projected Value of initial capital')

# plot % of scenarios that are still paying

p.alive = 1 - rowSums(is.na(nav)) / n.sim

plot(100 * p.alive, las = 1, xlab = 'Months', ylab = 'Percentage Paying',

main = 'Percentage of Paying Scenarios', ylim=c(0,100))

grid()

# plot distribution of final wealth

final.nav = nav[n.obs + 1, ]

final.nav = final.nav[!is.na(final.nav)]

plot(density(final.nav, from=0, to=max(final.nav)), las = 1, xlab = 'Final Capital',

main = paste('Distribution of Final Capital,', 100 * p.alive[n.obs + 1], '% are still paying'))

grid()

The corresponding Shiny web application consists of two files:

- ui.r – User Interface

- server.r – R simulations and calculations

Following is the user interface (ui.r) that maps and describes required inputs for the retirement simulation:

# Define UI for application that plots random distributions

shinyUI(pageWithSidebar(

# Application title

headerPanel("Retirement : simulating wealth with random returns, inflation and withdrawals"),

# Sidebar with a slider input for number of observations

sidebarPanel(

sliderInput("n.obs",

"Number of observations (in Years):",

min = 0,

max = 40,

value = 20),

sliderInput("start.capital",

"Initial capital invested :",

min = 100000,

max = 10000000,

value = 2000000,

step = 100000,

format="$#,##0",

locale="us"),

sliderInput("annual.mean.return",

"Annual return from investments (in %):",

min = 0.0,

max = 30.0,

value = 5.0,

step = 0.5),

sliderInput("annual.ret.std.dev",

"Annual volatility from investments (in %):",

min = 0.0,

max = 25.0,

value = 7.0,

step = 0.1),

sliderInput("annual.inflation",

"Annual inflation (in %):",

min = 0,

max = 20,

value = 2.5,

step = 0.1),

sliderInput("annual.inf.std.dev",

"Annual inflation volatility. (in %):",

min = 0.0,

max = 5.0,

value = 1.5,

step = 0.05),

sliderInput("monthly.withdrawals",

"Monthly capital withdrawals:",

min = 1000,

max = 100000,

value = 10000,

step = 1000,

format="$#,##0",

locale="us",),

sliderInput("n.sim",

"Number of simulations:",

min = 0,

max = 2000,

value = 200)

),

# Show a plot of the generated distribution

mainPanel(

plotOutput("distPlot", height = "600px")

)

))

The last step is modify the retirement simulation logic to use user inputs:

library(shiny)

# Define server logic required to generate and plot a random distribution

#

# Idea and original code by Pierre Chretien

# Small updates by Michael Kapler

#

shinyServer(function(input, output) {

# Function that generates scenarios and computes NAV.

getNav <- reactive({

#-------------------------------------

# Inputs

#-------------------------------------

# Initial capital

start.capital = input$start.capital

# Investment

annual.mean.return = input$annual.mean.return / 100

annual.ret.std.dev = input$annual.ret.std.dev / 100

# Inflation

annual.inflation = input$annual.inflation / 100

annual.inf.std.dev = input$annual.inf.std.dev / 100

# Withdrawals

monthly.withdrawals = input$monthly.withdrawals

# Number of observations (in Years)

n.obs = input$n.obs

# Number of simulations

n.sim = input$n.sim

#-------------------------------------

# Simulation

#-------------------------------------

# number of months to simulate

n.obs = 12 * n.obs

# monthly Investment and Inflation assumptions

monthly.mean.return = annual.mean.return / 12

monthly.ret.std.dev = annual.ret.std.dev / sqrt(12)

monthly.inflation = annual.inflation / 12

monthly.inf.std.dev = annual.inf.std.dev / sqrt(12)

# simulate Returns

monthly.invest.returns = matrix(0, n.obs, n.sim)

monthly.inflation.returns = matrix(0, n.obs, n.sim)

monthly.invest.returns[] = rnorm(n.obs * n.sim, mean = monthly.mean.return, sd = monthly.ret.std.dev)

monthly.inflation.returns[] = rnorm(n.obs * n.sim, mean = monthly.inflation, sd = monthly.inf.std.dev)

# simulate Withdrawals

nav = matrix(start.capital, n.obs + 1, n.sim)

for (j in 1:n.obs) {

nav[j + 1, ] = nav[j, ] * (1 + monthly.invest.returns[j, ] - monthly.inflation.returns[j, ]) - monthly.withdrawals

}

# once nav is below 0 => run out of money

nav[ nav < 0 ] = NA

# convert to millions

nav = nav / 1000000

return(nav)

})

# Expression that plot NAV paths.

output$distPlot <- renderPlot({

nav = getNav()

layout(matrix(c(1,2,1,3),2,2))

# plot all scenarios

matplot(nav, type = 'l', las = 1, xlab = 'Months', ylab = 'Millions',

main = 'Projected Value of initial capital')

# plot % of scenarios that are still paying

p.alive = 1 - rowSums(is.na(nav)) / ncol(nav)

plot(100 * p.alive, las = 1, xlab = 'Months', ylab = 'Percentage Paying',

main = 'Percentage of Paying Scenarios', ylim=c(0,100))

grid()

last.period = nrow(nav)

# plot distribution of final wealth

final.nav = nav[last.period, ]

final.nav = final.nav[!is.na(final.nav)]

if(length(final.nav) == 0) return()

plot(density(final.nav, from=0, to=max(final.nav)), las = 1, xlab = 'Final Capital',

main = paste('Distribution of Final Capital,', 100 * p.alive[last.period], '% are still paying'))

grid()

})

})

We all done now!!! Shiny is amazing in the way it allows you to convert your script into interactive web application with just two simple steps.

Please play around with the Retirement : simulating wealth with random returns, inflation and withdrawals – Shiny web application (code at GitHub).

Have a good weekend

R-bloggers.com offers daily e-mail updates about R news and tutorials about learning R and many other topics. Click here if you're looking to post or find an R/data-science job.

Want to share your content on R-bloggers? click here if you have a blog, or here if you don't.